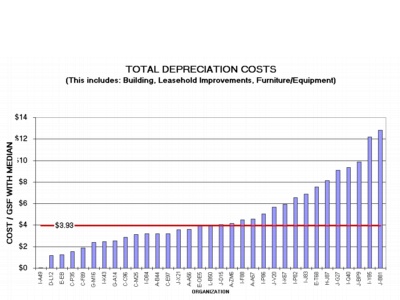

It is more essential than ever for businesses to interact with knowledgeable CPA firms like Creative Advising. With our experience in tax technique and bookkeeping, we are well-equipped to information companies through these modifications, ensuring they remain compliant whereas maximizing their tax financial savings. Nevertheless, a phaseout rule reduces the utmost annual Sec. 179 deduction if the taxpayer locations greater than $4 million of eligible assets in service through the year. Before the model new law, the scheduled Sec. 179 phaseout threshold for 2025 was $3.13 million. The increased Sec. 179 figures might be adjusted annually for inflation for taxable years starting in 2026 and beyond. Price segregation continues to be top-of-the-line ways to unlock early tax savings from real estate.

Taxpayers should contain a tax skilled early when considering the construction or buy of a potentially certified facility. Sec. 179 First-Year Depreciation Rules Are LiberalizedFor eligible assets placed in service in taxable years starting in 2025, under the OBBBA, a enterprise taxpayer can potentially write off up to $2.5 million with the Part 179 deduction. Nonetheless, a phaseout rule reduces the maximum annual Sec.179 deduction if the taxpayer places greater than $4 million of eligible assets in service during the year. Earlier Than the new law, the scheduled Sec.179 phaseout threshold for 2025 was $3.thirteen million. The elevated Sec 179 figures will be adjusted annually for inflation for taxable years beginning in 2026 and past.

Impression On Tax Liability For Companies

Our goal is to ensure that our purchasers are not only compliant with the brand new legal guidelines but are additionally positioned to take full benefit of the obtainable tax savings and incentives. This requires a proactive strategy to tax strategy, one that considers the long-term benefits of adapting to new strategies over clinging to outdated practices that may appear less burdensome within the short time period. By specializing in the potential for lost tax savings and incentives, Artistic Advising goals to guide companies by way of transitions in tax law, guaranteeing they emerge more financially strong and strategically agile.

The adoption of recent depreciation strategies is not merely a suggestion—it’s a necessity for making certain compliance with the newest tax laws. The forthcoming modifications in tax regulation relating to depreciation strategies set to take impact in 2024 are poised to have a considerable influence on the tax legal responsibility of companies. Inventive Advising understands that navigating these adjustments can be advanced, especially for businesses that have long-standing practices in place. The new depreciation methods are designed to more accurately mirror the financial life and utilization of property, probably allowing for extra significant deductions in the earlier years of an asset’s life.

- Creative Advising works intently with companies to investigate the specific impacts of these tax legislation modifications on their operations.

- You can write off the entire value on the corporation’s 2025 federal income tax return because of 100% first-year bonus depreciation.

- These provisions can have a substantial impression on taxable earnings, and fixed property and depreciation offer broad alternatives for tax planning for a wide array of taxpayers.

- Amongst its many provisions, the OBBBA reinstates 100 percent bonus depreciation for certified property acquired and positioned in service after January 19, 2025.

- Taxpayers ought to involve a tax skilled early when contemplating the development or buy of a probably certified facility.

- QIP applies to certain interior enhancements made to nonresidential buildings and can be a valuable planning tool when QPP therapy is unavailable or when improvements are made outdoors of production-related actions.

An inaccurate valuation can either deter funding or result in unfavorable terms for the enterprise. When businesses don’t swap to new depreciation strategies in 2024, one important space that will be considerably affected is monetary reporting and business valuation. At Creative Advising, we emphasize to our purchasers the importance of correct monetary reporting, as it’s elementary to the operational and strategic decision-making course of. Not updating depreciation methods can result in discrepancies in financial statements, particularly in the steadiness sheet and earnings assertion. This misrepresentation can skew the notion of the company’s financial health, potentially leading to misguided choices by administration, buyers, and collectors.

When property that have been depreciated over an accelerated schedule are offered, a portion of the acquire is taxed as strange earnings, to the extent of the depreciation claimed, quite than the decrease capital gains charges. Cost segregation is a tax technique utilized by real property house owners to categorise parts of a property into classes that allow for accelerated depreciation durations. By breaking down components corresponding to electrical installations, plumbing, and fixtures, property homeowners can depreciate parts of their property over 5, 7, or 15 years, instead of the usual 27.5 or 39 years.

We’ll Say It Again: One Hundred Pc Bonus Depreciation Is Now Permanent!

Part 179 expensing permits businesses to deduct the full buy value of qualifying property and software program purchased or financed through the tax 12 months, somewhat than capitalizing the expenses and depreciating them over several years. For a newly developed apartment complicated positioned in service in June 2025, the relevant bonus depreciation price may still be 40% if substantive building activities started in early 2024. First, a taxpayer could https://www.simple-accounting.org/ rely on the facts-and-circumstances take a look at, under which development is considered to have commenced when bodily work of a big nature begins. Activities corresponding to site clearing, test drilling, or securing design and permitting approvals do not rise to the level of great bodily work.

The OBBBA has greater than doubled the utmost deduction quantity and increased the usefulness of part 179 for mid-sized companies who heavily spend money on capital equipment or building enhancements. Bonus depreciation, ruled by IRC §168(k), permits businesses to deduct a portion (or all) of the cost of qualifying assets within the 12 months they are placed in service. This is distinct from regular depreciation, the place deductions are spread out over several years, generally recognized as the “life” of the asset. Careful documentation of those dates will permit for accurate utility of the bonus depreciation rules and help keep away from missed alternatives or compliance issues. Historically, bonus depreciation was confined to new property the place the unique use began with the taxpayer.

This accelerated depreciation may result in substantial tax financial savings for businesses that adapt to the new strategies. If you operate your business as a C corporation, there isn’t any limit on the value of eligible belongings that you could deduct within the first 12 months underneath 100% first-year bonus depreciation. For occasion, suppose your calendar-tax-year company acquires and places in service $10 million of eligible belongings after January 19, 2025, and before December 31, 2025. You can write off the entire value on the company’s 2025 federal earnings tax return thanks to one hundred pc first-year bonus depreciation. If the write-off causes a net operating loss (NOL) for the yr, the NOL can be carried ahead indefinitely to offset the corporation’s taxable earnings in future years. The enhancements to bonus depreciation expand access to the deduction, allowing extra companies to learn from increased upfront tax financial savings within the years forward.

Real Estate Acquisitions

Nevertheless, expenditures attributable to the enlargement of a building, elevators or escalators, or a building’s inner structural framework don’t rely as QIP and often must be depreciated over 39 years. If your corporation invests in qualified manufacturing property—basically, equipment or services used in U.S.-based manufacturing—you’ll now profit from 100 percent bonus depreciation via 2032. That’s eight full years of upfront tax savings for corporations producing items on American soil.

This is defined as an enchancment to an interior portion of a non-residential building positioned in service after the building was initially put into use. However, expenditures attributable to the enlargement of a building, elevators or escalators, or the inner structural framework of a building don’t depend as QIP. Depreciation choices underneath the OBBBA also can create ripple results in different key areas of the tax law.